What is a NIF in Portugal? The Ultimate Guide for New Arrivals 2026

TL;DR / Quick Answer: The NIF (Número de Identificação Fiscal) is a 9-digit Portuguese taxpayer identification number. It is the single most important document for living in Portugal; you need it to rent an apartment, open a bank account, get a phone plan, or sign a work contract. You can obtain it as a resident or non-resident through a legal representative like Coepi.eu.

Watch our one minute breakdown on what is needed for your NIF:

🚀 Start Your Journey Right

Don't let bureaucracy stall your dreams. 👉 Get Started with Coepi.eu Now and join thousands of arrivals who started their Portuguese life with confidence.

Why is the NIF the first step to your new life in Portugal?

In Portugal, your journey doesn't start at the airport; it starts with your NIF. Often called the Número de Contribuinte, this 9-digit number is issued by the Autoridade Tributária e Aduaneira (the Portuguese Tax Authority).

Without a NIF, the Portuguese "system" essentially does not see you. It is the "Master Key" for:

- Housing: You cannot sign a long-term rental lease (Contrato de Arrendamento) or buy property without it.

- Finance: Opening a Portuguese bank account (essential for D7/D8 residency visas) requires a NIF.

- Employment: To sign a legal work contract or register as a freelancer (Trabalhador Independente), the NIF is mandatory.

- Utilities: Setting up your first home requires a NIF for Wi-Fi, electricity (EDP), and water.

- Daily Life: In Portugal, the cashier will ask, "Deseja fatura com número de contribuinte?" Adding your NIF to receipts can actually lead to tax rebates at the end of the year.

Who needs a NIF in Portugal?

| Status | Requirement | Reason |

|---|---|---|

| Non-EU Residents | Mandatory | Required for all visa applications (D7, D8, etc.) |

| EU Citizens | Mandatory | Required if staying > 3 months or working |

| Investors | Mandatory | Necessary for purchasing assets or starting a business |

| Children & Dependents | Recommended | Often required for school enrollment (Matrícula) and healthcare access |

<div class="hs-cta-embed hs-cta-simple-placeholder hs-cta-embed-349240007884"

style="max-width:100%; max-height:100%; width:600px;height:277.640625px" data-hubspot-wrapper-cta-id="349240007884">

<a href="https://cta-eu1.hubspot.com/web-interactives/public/v1/track/redirect?encryptedPayload=AVxigLLFT%2F8fxSlDYG3caJgqk0fkPW%2BJBUNxYurA6V21FMSOxso8C%2F7xcFbaiqeRuJ3WekQfCKsD%2BO6%2FJwKiTTSz%2BmUKJX51twXu2tZdmeXFz9aoNqypj4aHZaVGlR6rL5zSd1QEl60Z%2FcXOuZRgIphMGc6N1RW7%2FcT6QluUx0Qi8TKrY2V2ENRb1UxKLBgfZFnhLA%3D%3D&webInteractiveContentId=349240007884&portalId=5794759" target="_blank" rel="noopener" crossorigin="anonymous">

<img alt="Your Portuguese NIF, Simplified. Skip the bureaucracy and high legal fees. Get your NIF for just €29,99 through our secure, lawyer-verified platform - delivered quickly so you can start your new life." loading="lazy" src="https://hubspot-no-cache-eu1-prod.s3.amazonaws.com/cta/default/5794759/interactive-349240007884.png" style="height: 100%; width: 100%; object-fit: fill"

onerror="this.style.display='none'" />

</a>

</div>How do I get a NIF as a foreigner? (The 2026 Process)

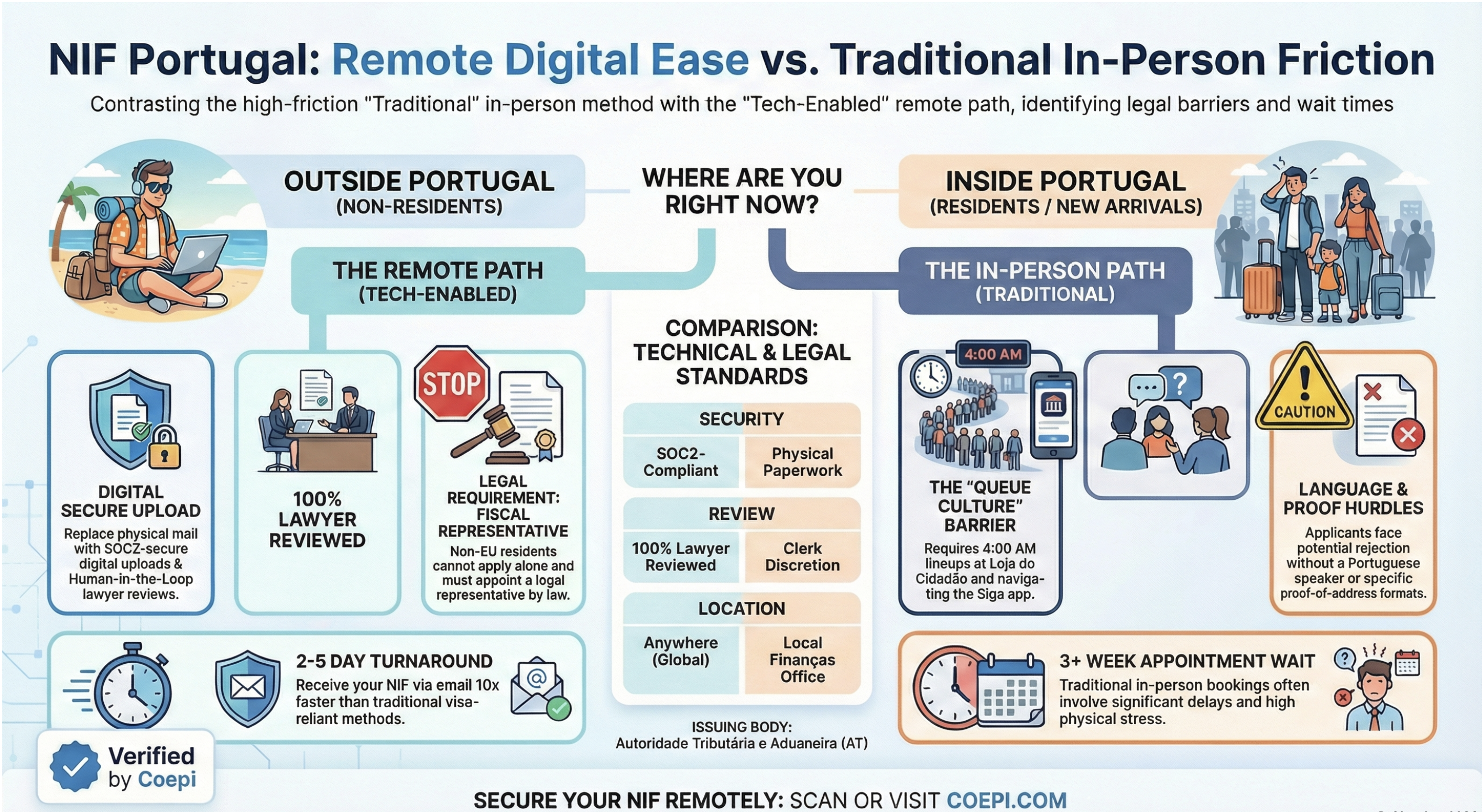

The process depends on your current location and residency status.

1. If you are outside Portugal (Non-Resident)

If you are applying for a visa from abroad (like the Brazilian freelancer seeking a D8 visa), you cannot apply directly at a tax office. You must appoint a Fiscal Representative (Representante Fiscal).

- Coepi.eu Solution: We act as your tech-enabled bridge. We handle the appointment of a legal representative and manage the digital submission to the Finanças portal, ensuring your NIF is ready before you buy your plane ticket.

2. If you are inside Portugal

You can visit a Loja do Cidadão or a local Finanças office. However, beware of:

- The "Queue" Culture: Many offices require appointments made weeks in advance via the Siga app.

- Language Barriers: Most tax forms and official interactions are conducted strictly in Portuguese.

- Proof of Address: You will need a validated proof of address from your home country (translated) or a local address.

What is a Fiscal Representative and do I need one?

A Fiscal Representative serves as the legal link between a non-resident and the Portuguese Tax Authority.

- Who needs one? Technically, as of 2023, EU residents don't legally require one, but anyone with a tax address outside the EU/EEA must have one to obtain a NIF.

- What are the responsibilities? They ensure you receive tax notifications and remain compliant. If you don't have a representative, you might miss deadlines for the IUC (Car tax) or IMI (Property tax), leading to heavy fines.

- The Coepi.eu Edge: We utilize a Human-in-the-Loop (HITL) model. While AI handles the data entry to keep costs low for "O Novo Chegado," a qualified Portuguese lawyer reviews every application to ensure 100% accuracy.

Avoiding the "Immigrant Tax": Common Scams to Watch For

The path to a NIF is often filled with "facilitators" charging exorbitant fees.

- The "Ghost" Representative: Some services assign a representative who disappears after the NIF is issued, leaving you unable to access your tax portal.

- Overpricing: Traditional law firms often charge €300-€500 for a simple NIF. A fair price for digital nomadic services should be transparent and accessible.

- Data Insecurity: Never send your passport scan via unencrypted WhatsApp groups. Coepi.eu uses SOC2-compliant infrastructure to protect your identity.

Beyond the NIF: Building Your "Document Cluster"

The NIF is just the first "Entity" in your Portuguese identity. Once you have it, you will likely need:

- NISS: (Número de Identificação da Segurança Social) – Your social security number for healthcare and pension.

- SNS User Number: (Número de Utente) – To access the public health system.

- Finanças Password: (Senha das Finanças) – Your login for the online tax portal.

Expert Tip for 'O Novo Chegado'

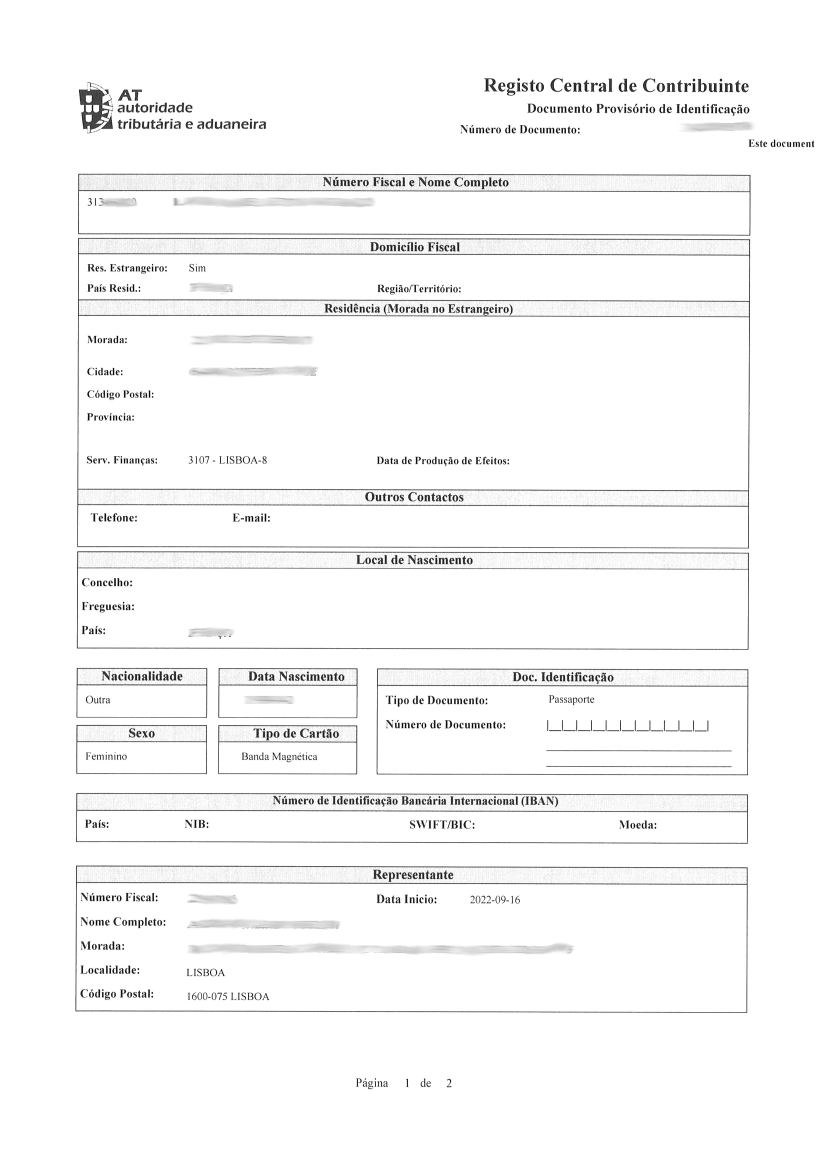

When you receive your NIF document (the Documento de Identificação Fiscal), check the "Address" field. If you used a fiscal representative, it will likely show their address. Once you move to Portugal and get a rental contract, your first priority should be updating your address on the portal to transition from "Non-Resident" to "Resident" status. This is crucial for tax benefits like the NHR (Non-Habitual Resident) scheme.

<div class="hs-cta-embed hs-cta-simple-placeholder hs-cta-embed-349758554311"

style="max-width:100%; max-height:100%; width:700px;height:537.4765625px" data-hubspot-wrapper-cta-id="349758554311">

<a href="https://cta-eu1.hubspot.com/web-interactives/public/v1/track/redirect?encryptedPayload=AVxigLLi636HCnKHfHcpQDMI8Y2haPuGhNYp7oyyCY9OdX%2BR2zLGcCqW4JCAmkSTB5W4IlSW%2FEJGdcfF0iyKMOYg4t%2FNzqEfEdNvtMy1Or3tvRbnvwxVAyVBYrDYw1L7VUpVdg5ODO4WRzLCcg1g40k%2FkoObnDquz2QoTKgh4hJZz%2B3pvVEvNgKxHZvz4lFwOX2bzQ%3D%3D&webInteractiveContentId=349758554311&portalId=5794759" target="_blank" rel="noopener" crossorigin="anonymous">

<img alt="Start Your Journey for €29,99 While traditional firms charge €300-€500 for a NIF, we've built a smarter solution: AI-powered efficiency combined with lawyer-reviewed accuracy." loading="lazy" src="https://hubspot-no-cache-eu1-prod.s3.amazonaws.com/cta/default/5794759/interactive-349758554311.png" style="height: 100%; width: 100%; object-fit: fill"

onerror="this.style.display='none'" />

</a>

</div>At Coepi.eu, we speak your language, understand your pain, and prioritize your start. Because "Coepi" means "I began" - and we're here to make sure you begin right.

Frequently Asked Questions (FAQs)

Does getting a NIF make me a tax resident in Portugal?

No. Obtaining a NIF identifies you but does not automatically trigger tax residency. You typically become a tax resident only after spending 183 days in the country or establishing a permanent residence.

Can I get a NIF online?

Yes, but only through a legal representative who has access to the Portal das Finanças professional area. Individual foreigners cannot currently apply online for their first NIF without a representative.

What documents are required for a NIF?

You generally only need a scanned copy of your valid Passport and Proof of Address from your current country of residence (e.g., a utility bill or bank statement).

Coepi, the humans behind your first step.