Do I Need a Fiscal Representative in Portugal 2026?

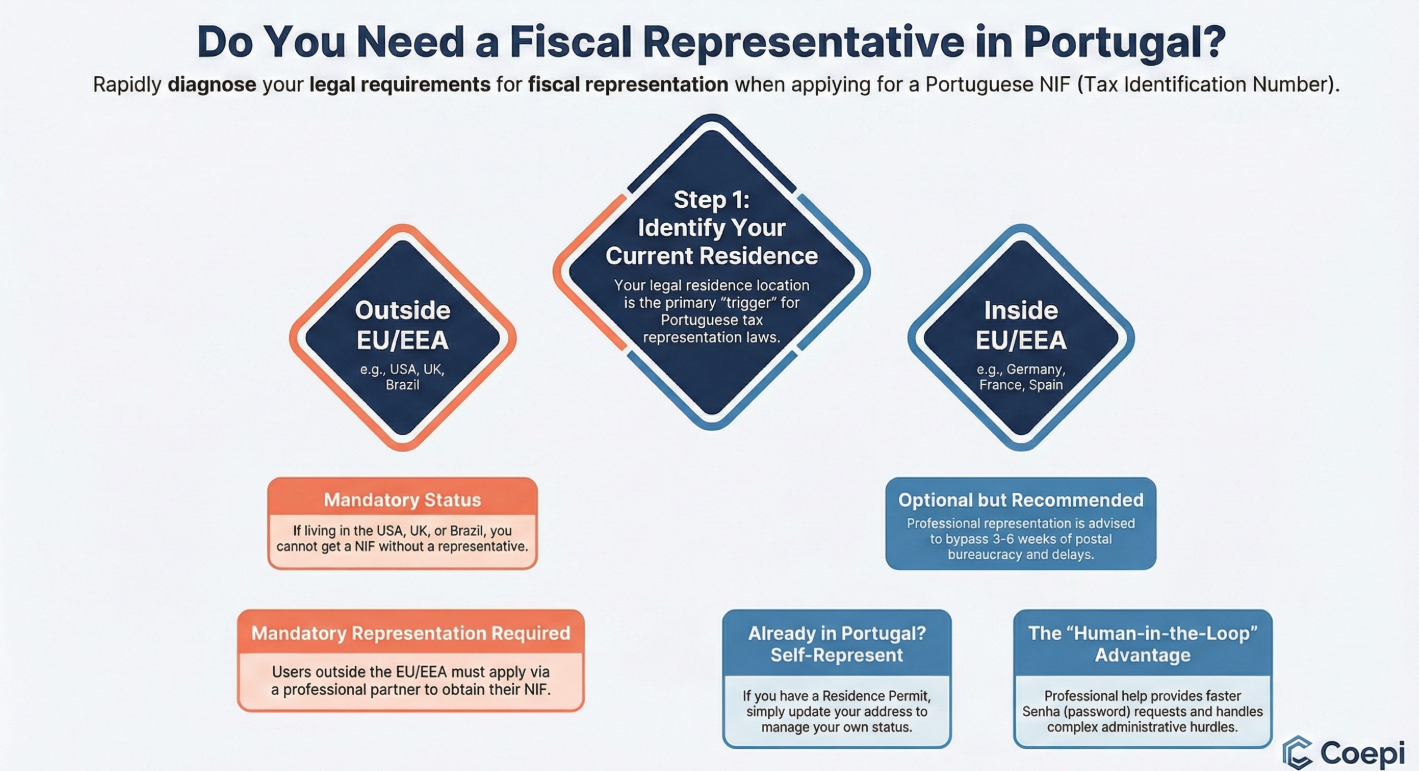

TL;DR: If you reside outside the EU/EEA, a Fiscal Representative is legally mandatory to obtain your NIF and act as your official liaison with Finanças. For EU residents, it is optional but recommended to avoid bureaucratic delays. Coepi provides a professional, HITL-verified representation service to ensure you never miss a tax deadline.

What is a Fiscal Representative and why is it mandatory?

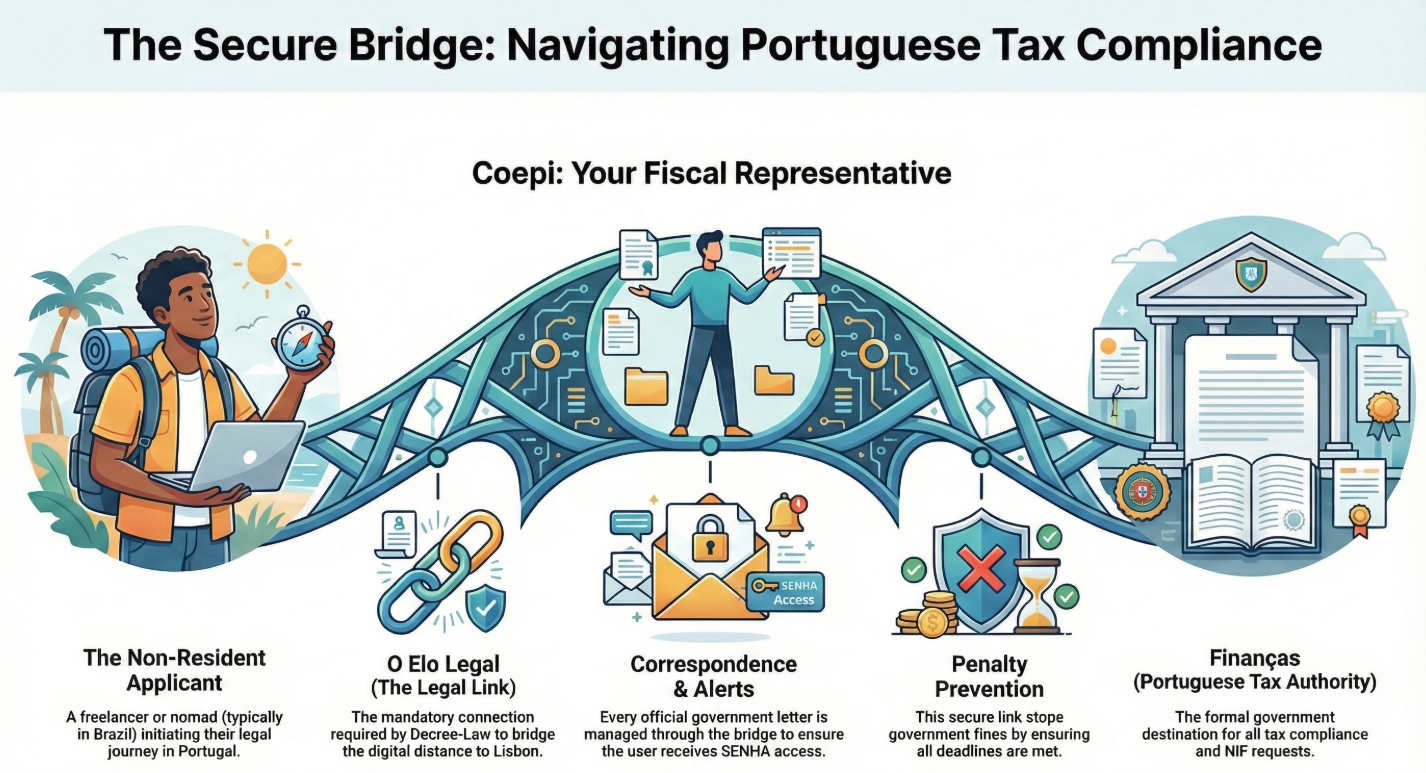

In Portugal, a Fiscal Representative (Representante Fiscal) is a tax-resident individual or entity that acts as your legal bridge to the Autoridade Tributária e Aduaneira (Finanças).

If you are a non-EU/EEA resident, you cannot legally hold a Portuguese Tax Identification Number (NIF) without one. They are responsible for:

- Entity Linking: Receiving official correspondence regarding your NIF, property taxes (IMI), and income tax (IRS).

- Legal Safeguarding: Ensuring you are notified of tax obligations within the strict Portuguese legal deadlines.

- Bureaucracy Shield: Acting as your physical "mailbox" in Portugal so the government has a guaranteed point of contact.

$$CTA 1 - TEXT LINK$$

: Confused about the NIF process?

$$Download our free "NIF & Residency Roadmap" for Brazilians$$

Who is required to appoint a Representante Fiscal?

Residency Status

Legal Requirement

Why?

Non-EU/EEA Resident

Mandatory

Required by Decree-Law to issue a NIF and ensure tax reachability.

EU/EEA Resident

Optional

Not legally required, but useful if you don't speak Portuguese or lack a local address.

Portuguese Resident

None

Once you change your address to Portugal, you "prune" the need for a representative.

How does the Fiscal Representation process work for Brazilian Freelancers?

For many in the Brazilian diaspora, the Fiscal Representative is the first Human-in-the-Loop (HITL) contact in their European journey. This role is especially critical for freelancers who need to remain compliant while transitioning between jurisdictions.

- NIF Application: Your representative submits your documentation to Finanças.

- Address Linking: Your NIF is linked to their Portuguese address initially.

- Ongoing Compliance: They receive your "Senha das Finanças" (portal password) and forward it to you securely.

Pro-Tip for Nomads: Don't just ask a "friend" to be your representative. If they move or forget to check their mail, you are liable for the fines. Professional representation through Coepi ensures Experience, Expertise, Authoritativeness, and Trustworthiness (E-E-A-T).

Can I remove a Fiscal Representative later?

Yes. This is a common part of the "Immigration Roadmap." Once you obtain your residence permit (Title of Residence) and have a fixed address in Portugal, you perform an Address Update at Finanças.

$$VISUAL 3: SIDE-BY-SIDE IMAGE - "Before vs. After Residency". Left: NIF linked to Representative. Right: NIF linked to your new home in Lisbon/Porto.$$

- Step 1: Register your Portuguese lease or property deed.

- Step 2: Update your NIF address via the Portal das Finanças.

- Step 3: The fiscal representation requirement is automatically waived.

$$FINAL CTA - BUTTON$$

Secure Your Legal Start in Portugal

Don’t let bureaucracy stall your adventure. Get your NIF with professional fiscal representation starting today.

$$BUTTON: GET MY NIF NOW$$

Frequently Asked Questions (FAQs)

"What happens if I don't have a fiscal representative in Portugal?"

Without one, as a non-EU resident, your NIF application will be rejected. If you already have a NIF and move outside the EU without appointing one, you risk fines ranging from €50 to €5,000 and the suspension of your fiscal rights.

"How much does a fiscal representative cost?"

Prices vary from "free" (friends) to €300/year (law firms). Coepi democratizes this by offering professional representation bundled with NIF services at a transparent, affordable rate designed for O Novo Chegado.

Coepi, the humans behind your first step.